On average, small and medium business (SMB) owners have less than one month of cash buffer[1]. So when a new opportunity comes around to invest in expanding–or additional cashflow is required to sustain the business through a dry spell, SMBs apply for a loan in order to keep the business running.

Most small business loans fall into one of the following categories (Mills, 2019):

- 59% of SMB loans are used for business expansion and new opportunities – Financing is accessed in order to open new location, hire new people, buy a new machine.

- 43% of SMB loans are used for Operating Expenses– Financing is accessed in order to smoothen cashflow bumps due to seasonality.

- 26% of SMB loans are used for refinancing previous loans.

- 9% of SMB loans are used for other.

Borrowing Challenges for SMBs

For many SMBs, it can be a challenge to access loans to build their business, or operate through slower seasons. Many SMBs try to work with traditional financial institutions to obtain a commercial loan, but since banking processes are often built for larger loans, it can be cumbersome to obtain a smaller loan. Traditional, paper-based loan applications require SMB owners to track down, organize and submit reams of financial documentation and collateral. And even then, credit decision timeframes can take days or weeks.

Lending Challenges for Financial Institutions

And for financial institutions looking to lend to SMBs, there also are a number of operational challenges.

Generally speaking, the data used by legacy underwriting systems is more applicable for larger size loans. The processes in place for smaller-sized loans are generally just as time-consuming and documentation-heavy as those for larger. This is why smaller-ticket size loans may not be profitable for banks with current processes and systems.

In addition to being high-cost clients to acquire and underwrite, some banks also consider SMEs to be high-risk from a lending standpoint.

Part of the issue is building a clear picture of an SMB clients’ credit history in order to determine their risk profile. To start, there can be limited SME coverage by credit reporting service providers. Additionally, it can be challenging to obtain a clear picture of an SMB’s financial management capabilities, which can impact their credit risk profile.

Why is SME or SMB Financing Important?

When SMBs fail to access capital, it often means the difference between the life and death of their business. The number of new SMBs in the United States dropped from 500,000 to 400,000 annually between 1994 to 2015 (Mills: 2019). In the U.S. economic system, 30% to 50% of small businesses fail within 5 years of conception and limited capital resources is frequently identified as one of the top 5 causes of failure to thrive[2].

Quick Facts: Understanding the SMB Finance Gap

- How big is the SMB finance gap? In 2017, 40% of SMBs applied for a loan.

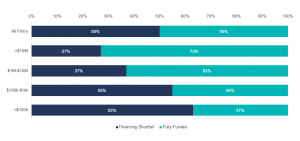

- How many smaller SMBs aren’t receiving the funding they need to grow and thrive? 63% of SMBs with annual revenue under 100K are struggling to receive full funding.

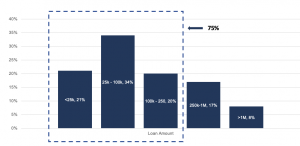

- How big is the average SMB loan? According to the 2017 SMB Credit Survey of Loan Sizes, 55% of SMB loan applications in the United States are under 100K[3].

The smaller the SMB, the harder it is for them to receive full funding.

Closing the SMB Financing Gap

It’s clear that SMBs are struggling to access more funding. And for community banks and credit unions, this presents a huge opportunity to scale their SMB lending offerings to help close the SMB financing gap.

Figuring out how to streamline the loan process and loan more profitably to SMBs is the only barrier to surmount for financial institutions looking to scale their SMB loanbook and access more revenue through this channel.

[dt_gap height=”20″ /]

Streamlining the Loan Process

While larger banks may opt to build their own solution for automated small business lending, credit unions and community banks are beginning to partner with fintechs in order to access the technology required to profitably scale their SMB lending processes. This can include implementing:

- Automated Underwriting – What if digital underwriting could make lending possible in real-time? In minutes?

- Credit Risk Analysis – What if you could offer your customers loan or mortgage credit risk analysis in mere minutes?

- Portfolio Reporting & Risk Monitoring – What if you could track financial performance trends and risk factors on an ongoing basis, while identifying growth opportunities in your clients’ businesses’?

Looking for SMB lending trends beyond 2020? Read our 7 Trends Driving Banks & Credit Unions to Increase SMB Lending in 2022 post.

Why JUDI.AI?

We believe in helping credit unions and community banks access deeper, faster financial insights about their members, by leveraging risk assessment data through machine learning. Book a demo today to learn more about our powerful lending software.

[dt_divider style=”thin” /][dt_gap height=”20″ /]

[1] Fintech, Small Business & the American Dream: Karen Mills, 2019.

[2] The Incredible Power of a Small Business: J. Graham, 2011.

[3] Small Business Credit Survey of Loan Sizes, FED Small Businesses, 2017.