With the frenzy that was the Paycheck Protection Program (PPP) now in the rear view mirror, community bankers are turning their attention to planning for the future. Based on JUDI.AI’s insights with community bank and credit union executives, we’re beginning to see an inflection point in the market around small business lending – an inflection point that’s driven by seven key SMB lending trends driving banks and credit unions to increase their lending to small businesses.

- Post-PPP demand for small business lending remains strong

- Banks are looking to increase loans to deploy surplus deposits

- Staffing uncertainty brings operational inefficiencies to the forefront

- Competition heats up as fintechs explore small business lending

- Credit unions are also waking up to the SMB lending opportunity

- Investments in SMB lending technology and machine learning are increasing

- Small businesses are open to sharing data if it means enhancing the lending experience

#1: Post-PPP Demand for SMB Lending Remains Strong

Prior to COVID, community banks were already responsible for 40% of all small business loans, despite only accounting for 15% of all banking assets. As ICBA notes, during COVID, community banks continued to step up in a major way, funding 60% of all PPP loans, including 72% of PPP loans to minority-owned businesses.

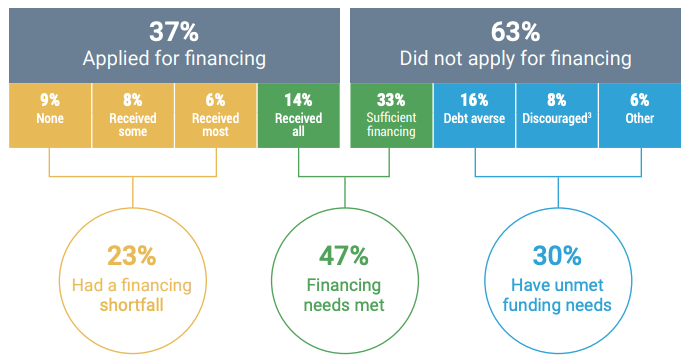

However, we still see a considerable unmet need for funding. With managing cash flow a constant challenge, a JUDI.AI survey revealed that 41% of SMBs need more access to credit. In fact, 65% of small businesses said they would grow their revenues with more access to capital.

“There has to be a follow-up to PPP loans to small businesses, and we view that as one of our missions. Because if we don’t strengthen our small businesses, we can’t strengthen our communities.” Carlos P. Naudon, President and CEO, Ponce Bank

Source: Federal Reserve Bank, 2021 Small Business Credit Survey

#2: Banks are Looking to Increase Loans to Deploy Surplus Deposits

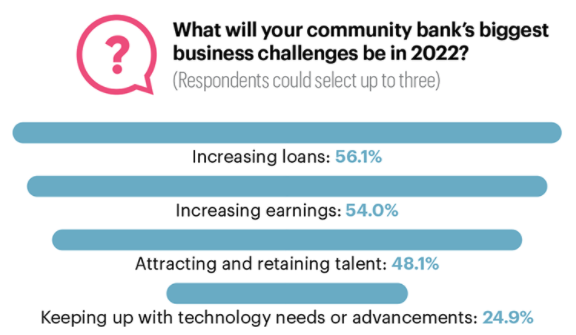

Among the top businesses challenges for community banks are increasing loans (56%) and increasing earnings (54%). At the top of the to-do list is making more loans to offset the influx of deposits driven by pandemic relief programs.

“When I talk to other CEOs across the country, they tell me the same thing: PPP borrowers who were first rejected by their larger bank decided to stop being customers there and brought over their entire relationship to the community bank that gave them a PPP loan. As a result, we’re more challenged with liquidity than the larger banks.” Janet Silveria, President and CEO, Community Bank of Santa Maria

So where to deploy those deposits? 56% of community banks cite small business loans as a high priority in 2022, while 32% of community bank CEOs see small business lending as the revenue stream most likely to drive profitability.

Source: Independent Banker, Community Bank CEO Outlook 2022

#3: Staffing Uncertainty Brings Operational Inefficiencies to the Forefront

The Great Resignation is impacting employers across the country and community banks are no exception. 48% of community bank CEOs list attracting and retaining qualified staff as one of their primary business challenges.

Not surprisingly, 35% of community bank CEOs also view investing in digitalization as a top business priority in 2022. According to the Financial Brand, “Business banking … remains stuck in neutral, saddled with legacy tech and processes, many of which are still largely paper-based.”

When employee turnover is high and experienced, knowledgeable resources are at a premium, simplifying, streamlining and automating manual processes is critical to effectively scaling your SMB loan program.

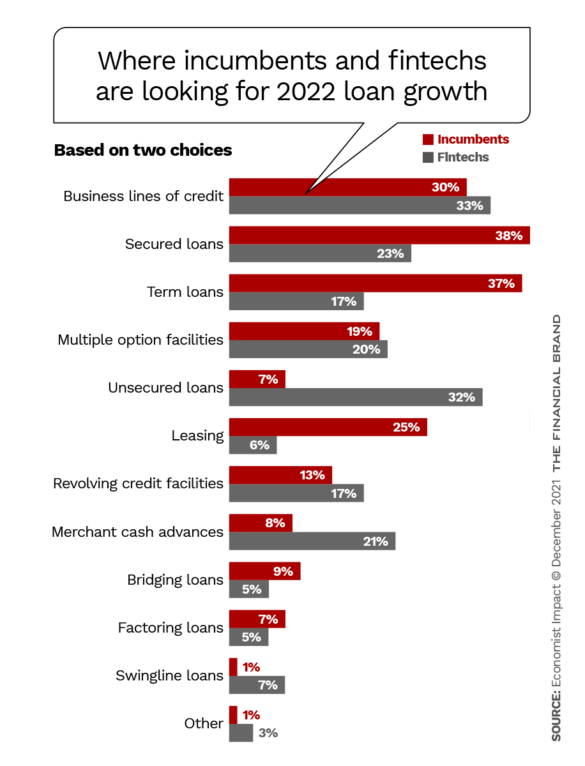

#4: Competition Heats up as Fintechs Explore Small Business Lending

At the same time, those operational inefficiencies are driving fintechs to target business lending as a source of new loan growth. “These new entrants are most active in the smaller loan space (defined as loans less than $50,000) – an area not often targeted by banks – but are gaining traction now even in larger loan amounts,” noted the Financial Brand.

Source: Financial Brand, Top Trends Transforming Business Banking in 2022 and Beyond

#5: Credit Unions are Waking up to the SMB Lending Opportunity

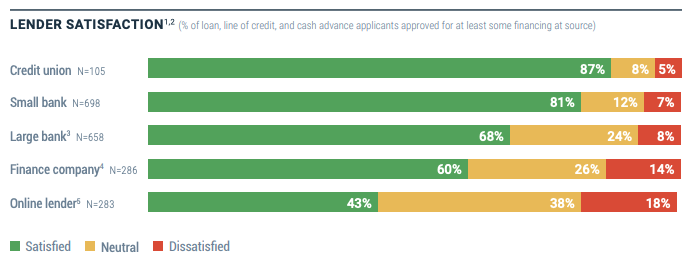

In recent years, small business lending has been a lower priority for credit unions, with 5% of PPP applications and <10% of overall SMB loan applications. However, not only do SMBs tend to be more satisfied with the lending experience they receive from credit unions, but many already have existing non-lending relationships with credit unions. This is a significant contributing component to the SMB lending trends of 2022.

Source: Federal Reserve Bank, 2021 Small Business Credit Survey

#6: Investments in SMB Lending Technology & Machine Learning are Increasing

Community banks and credit unions are recognizing that legacy systems won’t meet their needs moving forward. According to Cornerstone Advisors, nearly one in four community banks are looking to select a new small business digital loan origination system in 2022. In addition, 22% of mid-size financial institutions expect to invest in machine learning in 2022, with key use cases related to credit modeling and risk management.

#7: Small Businesses are Open to Sharing Data (if it Enhances the Lending Experience)

When selecting a lender, SMBs point to interest rates and loan amounts as the primary drivers. However, the loan experience also plays a key role, including ease of application process and speed of decision. Nearly half of SMB owners would grant read-only access to bank data for the right reasons, such as streamlining business loan approval. Incorporating alternative data sources, such as cash flow, can help reduce the loan decision to a matter of minutes.

JUDI.AI is a small business lending analytics platform that helps community banks and credit unions lend more for less risk with an approach that’s friendly, fast and profitable. With JUDI, our clients can process 50% more SMB loan applications with no added resources, approve 20% more loans with no added risk and decision a loan in less than 10 minutes. Interested in learning more?

By Kyle Thom, Director of Marketing, JUDI.AI

Headline photo by Adam Winger on Unsplash