Why small business lending?

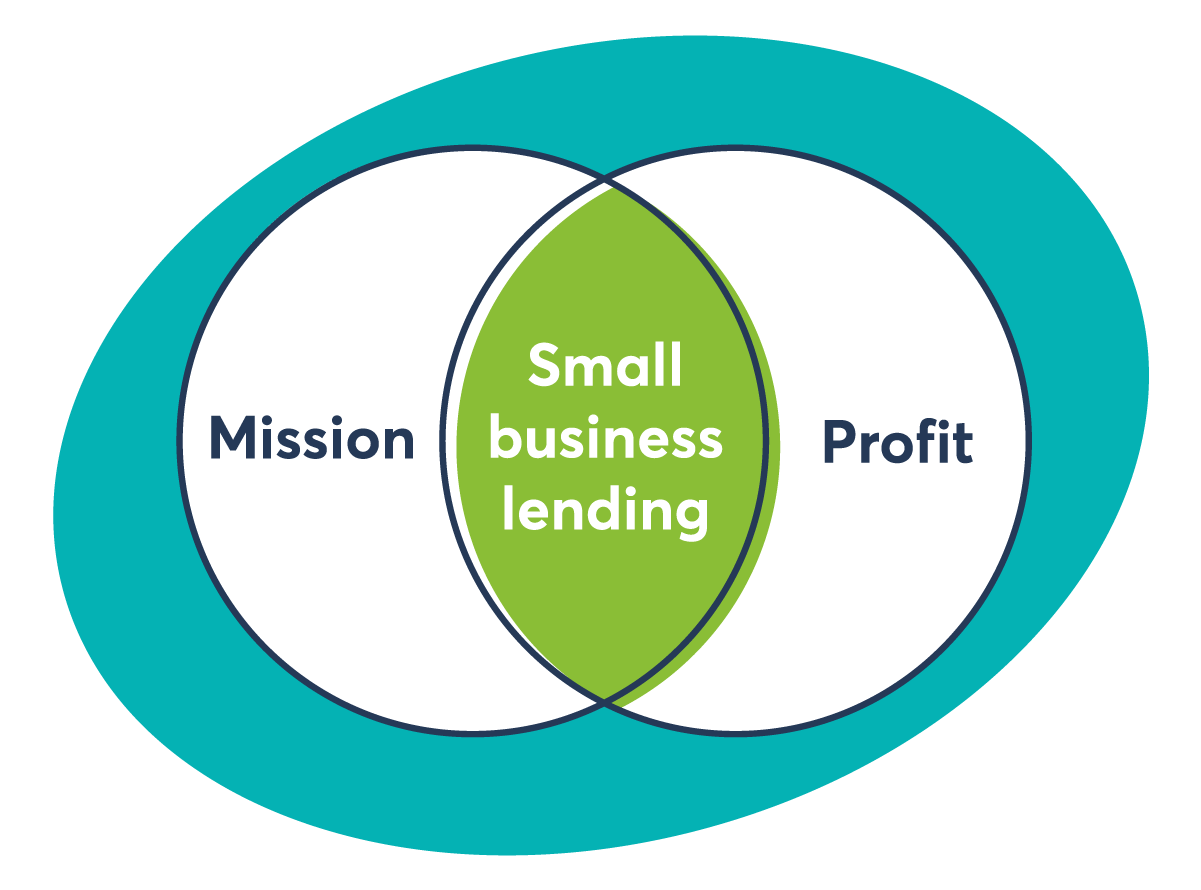

A tectonic shift is transforming small business lending from an obligation to a compelling proposition, where mission and profit are no longer mutually exclusive.

Double down on what you do well

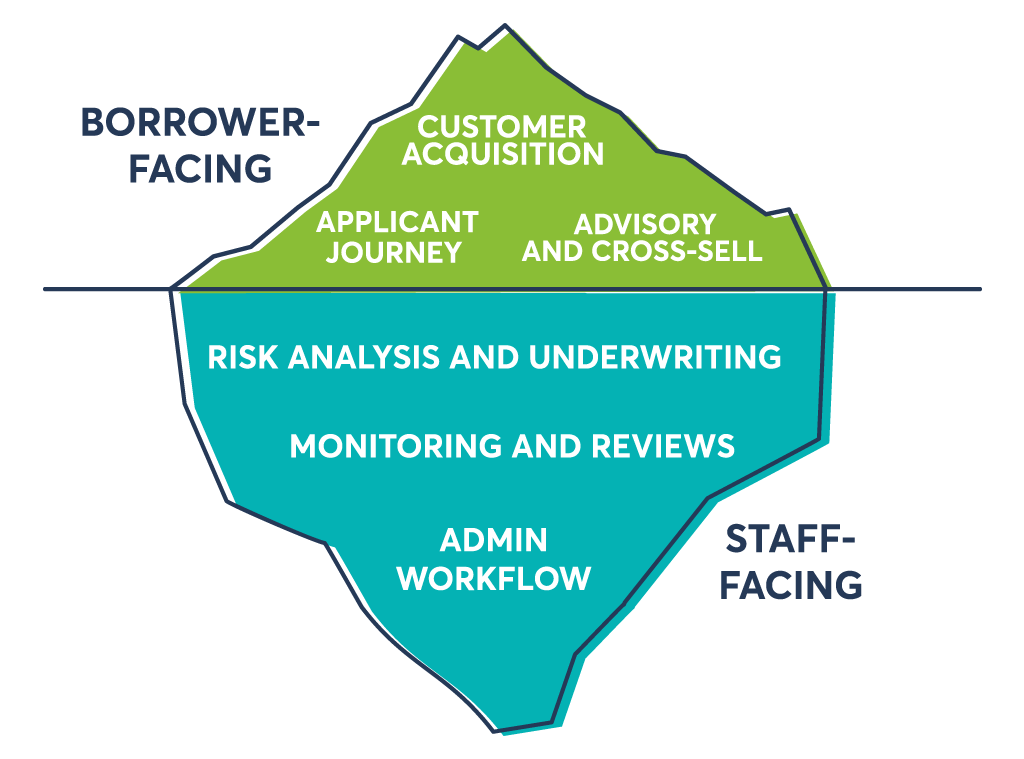

As a community lender, you’re already well positioned to win – incumbent relationships, a trusted brand, a lower cost of capital and a valuable personalized service model.

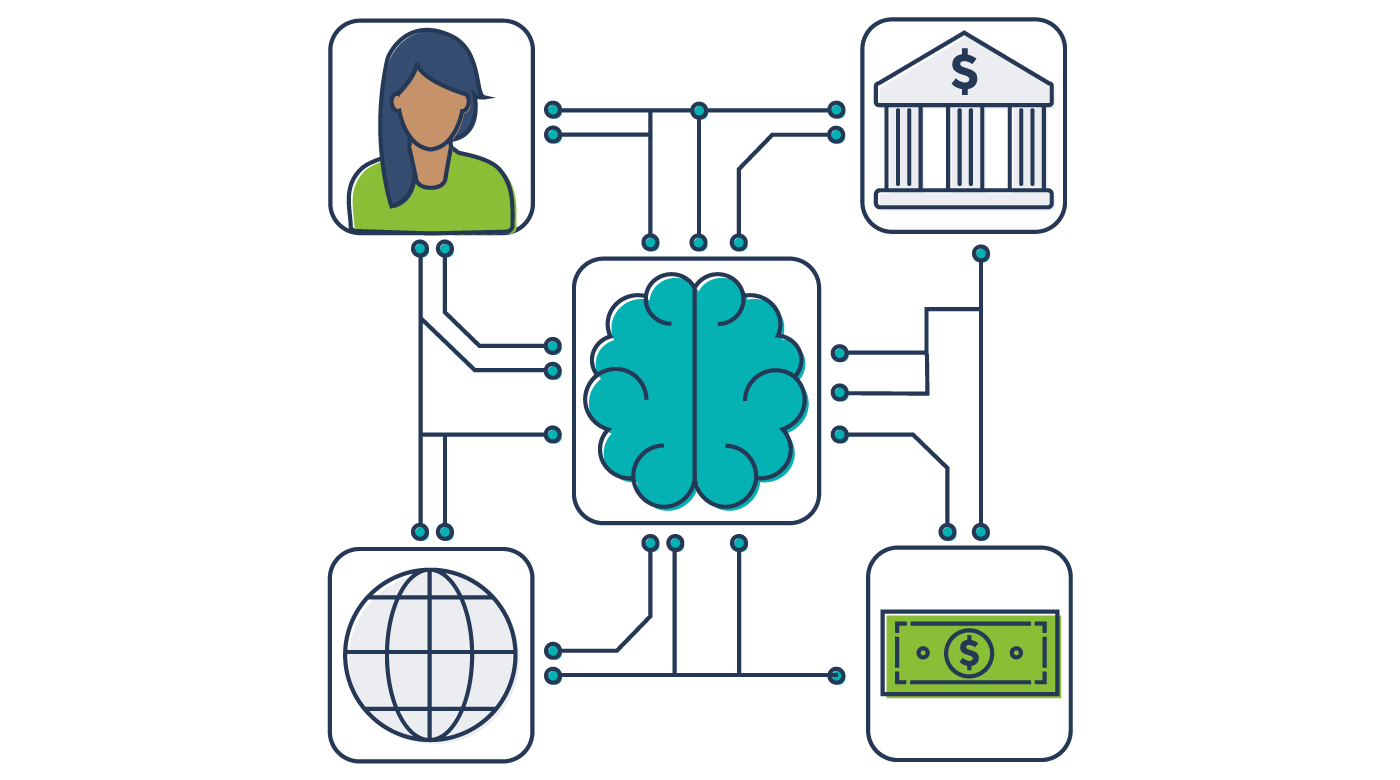

Reinvent yourself to compete and win in a digital world

Use open banking technology to acquire real-time data without friction. Use machine learning and artificial intelligence to organize and action that data.

“The use of alternative data and machine learning has been shown in several cases to improve credit assessments.”

Source: Federal Reserve Bank of Philadelphia, The Impact of Fintech Lending on Credit Access for U.S. Small Businesses

Dimensions of reinvention

A compelling business case

With spreads substantially higher on small business loans, a small business lending program could yield hundreds or even thousands of local small businesses funded and an outsized contribution to net interest income.

“The formula for success boils down to the following: Incumbent acquisition advantage + reinvention = viable economics.”

Source: Celent, Reinventing Small Business Credit

A strategic mandate

We know you strive to support your local communities every day. Small businesses are the heartbeat. Small business loans are highly strategic products that anchor broader banking relationships.