The juice was just not worth the squeeze…

Historically, the economics of small business lending have been untenable – smaller dollar loans, time-consuming manual processes and higher risk.

Many lenders don’t have a separate process

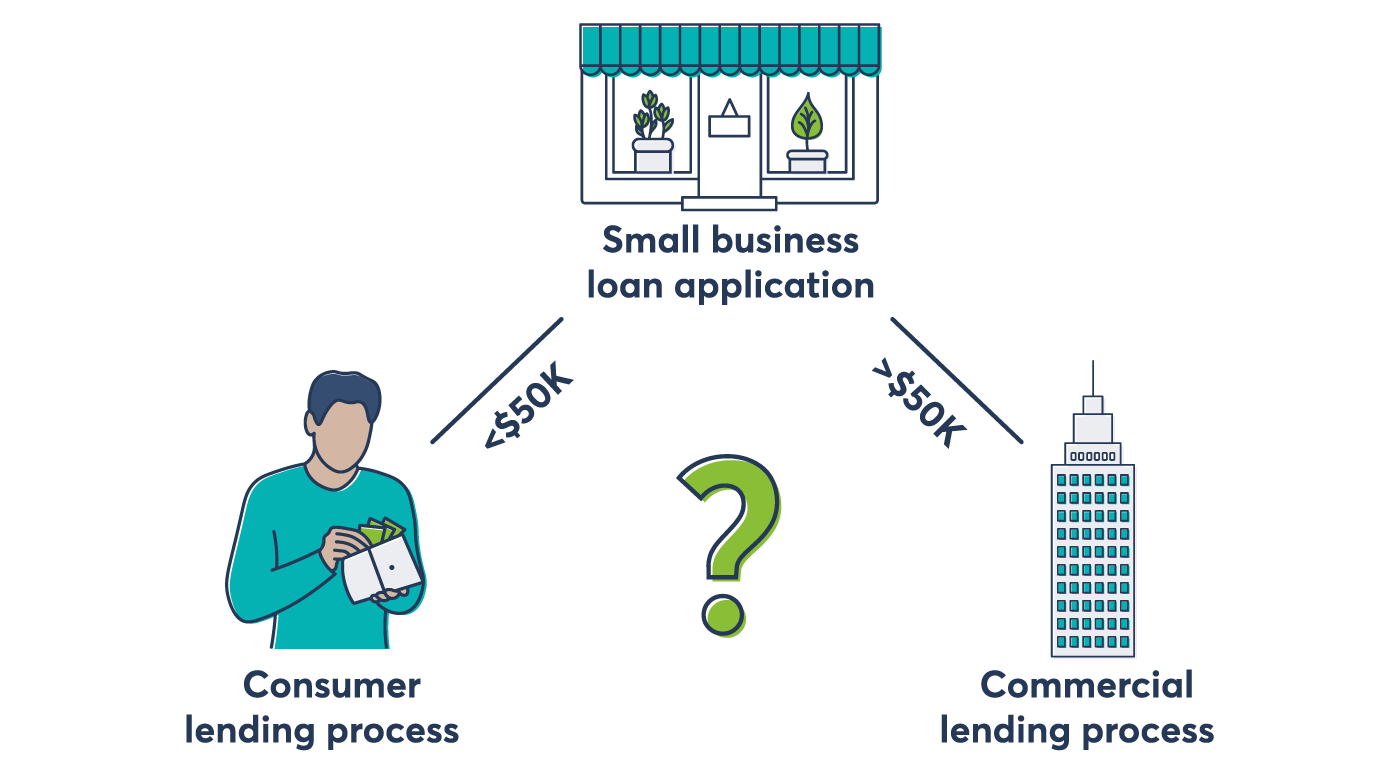

Small business loans are often handled differently, depending on size. The consumer lending approach is based largely on credit score, which offers insufficient rigor for small businesses. On the other hand, commercial lenders lean heavily on manual analysis of financial statements, resulting in excess process.

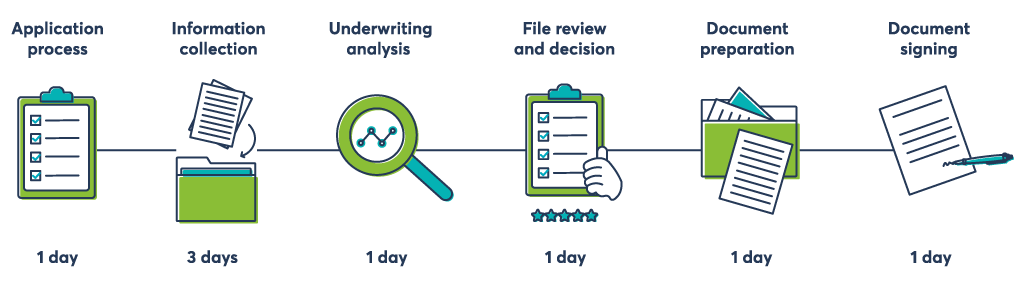

It can take 7 days (or more) to underwrite a small business loan

“I would rather eat a bag of nails than collect financial statements from a small business.”

Source: Chief Lending Officer at a $1B community bank

Did you know?

Armed with an easy digital experience, fintechs like Square are generating billions of dollars in loans to small businesses – loans that should be right in your wheelhouse.