“Open banking” credit model

Quickly and accurately predict risk using our proprietary, small business-specific credit model.

Cash (flow) is king

Powered by Machine Learning, our credit model uses real-time bank transaction data to evaluate creditworthiness, offering a more accurate snapshot into the financial health of a small business.

Proprietary transaction categorization engine

This is part of the AI in JUDI.AI. In about 60 seconds, JUDI collects permissioned banking transaction data and, using Natural Language Processing, organizes it automatically into a real-time synthetic financial statement. No need to collect financials manually!

Continuous improvement

This is another part of the AI in JUDI.AI. Building on our years of small business loan performance data, we use Machine Learning to regularly enhance the effectiveness of the credit model.

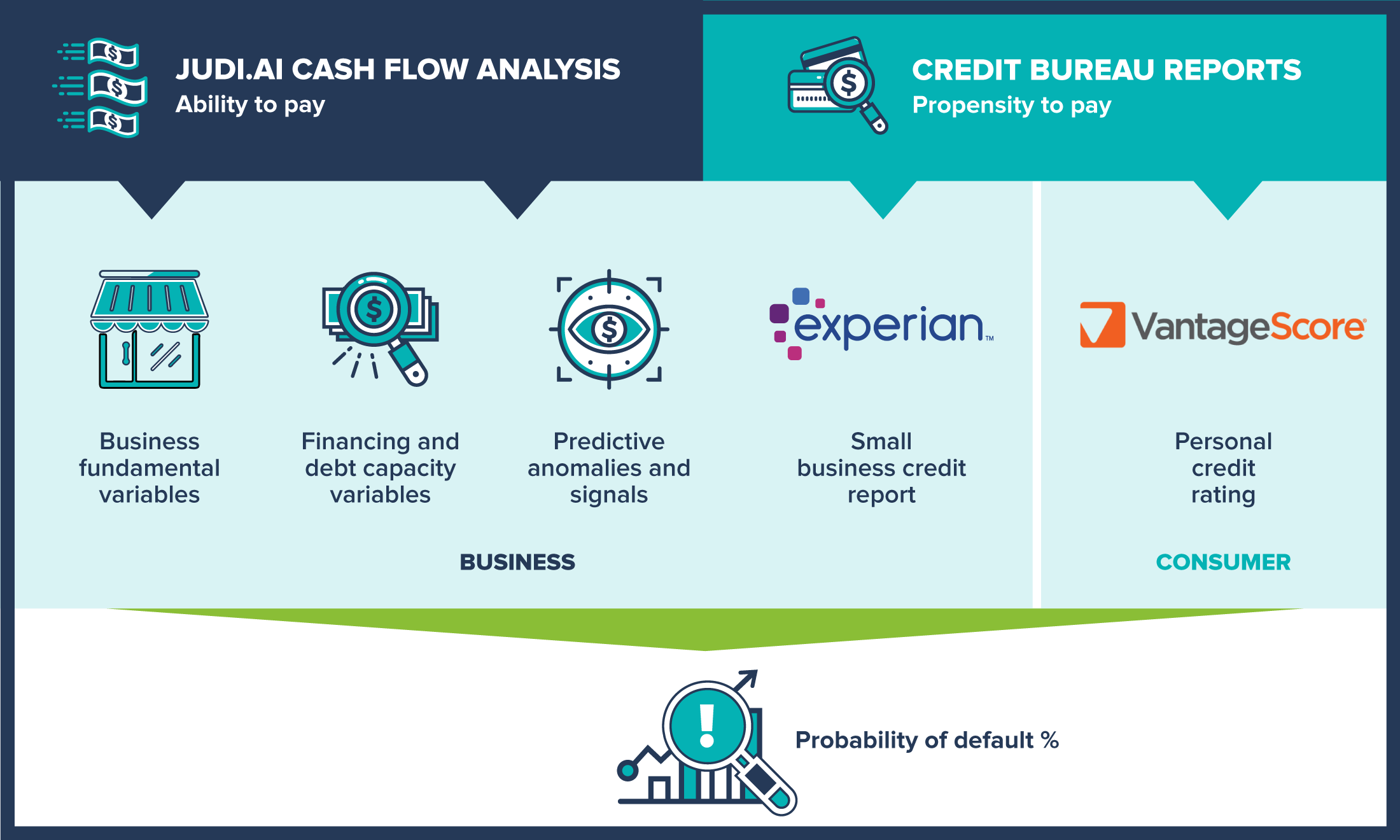

A better loan decision blends traditional credit data with alternative data that’s proven to be most predictive of risk

Proven performance

Compared to a credit score-only approach, our credit model delivers 20% more approved loans with the same level of risk, or 30% less risk with the same volume of loans.