Determining accurate creditworthiness with an SMB-specific credit risk model and cash flow data analysis.

This is the last part of a blog series that explores how innovation in small and medium business (SMB) lending can help community banks and credit unions grow their loan portfolios and form deeper, more profitable customer relationships. Previous posts focused on the importance of digitization, continuous risk monitoring and cloud-based lending technology solutions. This blog considers the benefits associated with SMB-specific credit risk models that incorporate cash flow analysis.

Riding the momentum of PPP

The urgency of the Paycheck Protection Program (PPP) pushed many community banks and credit unions to adopt faster, more convenient ways to perform loan application intake, automate underwriting processes and disburse funds to small businesses. As a result of their digitization efforts, many financial institutions were rewarded with the onboarding of new PPP customers – and a future opportunity for business banking growth if they can successfully convince these somewhat transient customers to stay.

Preparing for the next phase of SMB lending

As traditional SMB lending programs start to resume, community banks and credit unions are up against some fresh challenges. As of the end of March 2021, the scale of deposits still continue to outpace loan demand. Low rates and government payments have resulted in more paydowns, refinancing and loan portfolio turnover. Establishing the true creditworthiness of SMB borrowers has also become trickier, thanks to a provision in the government’s coronavirus stimulus package, stating lenders that allow borrowers to defer their debt payments cannot report these payments as late to credit-reporting companies. These reporting restrictions mean any higher risk of default associated with missed and deferred payments over the past few months will not be reflected in traditional scoring models.

If these are challenges you are currently grappling with, know you are not alone.

Innovating SMB lending with SMB-permissioned cash flow data

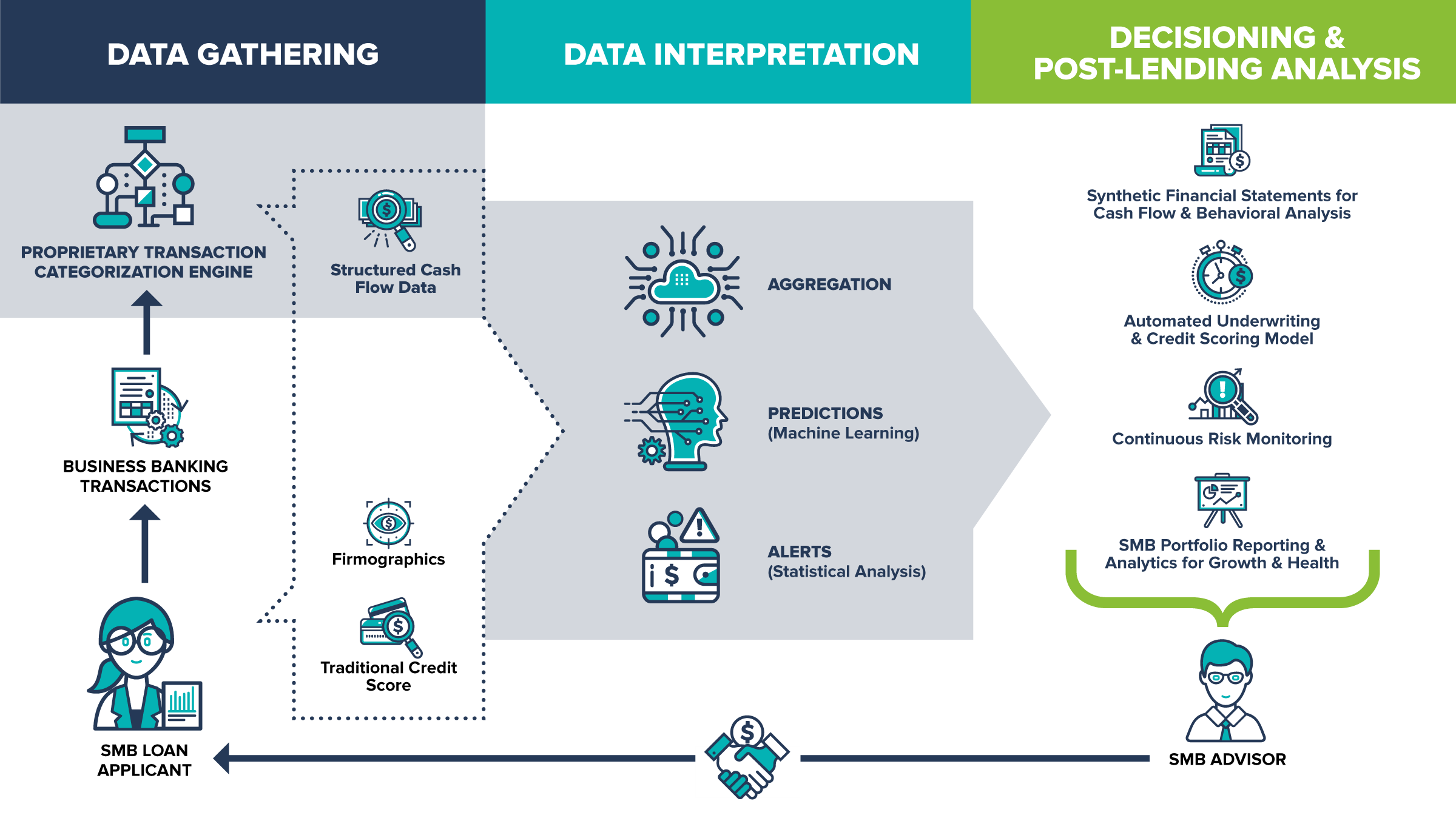

SMB-specific credit risk models are proving to be very powerful when it comes to maximizing returns on small business relationships. These advanced lending analysis platforms will often incorporate AI and alternative data such as real-time cash flow insights to help you understand the current financial health of a small business borrower – something that is concealed by the long-term nature of traditional credit scores. Cash flow analysis is key to helping you:

- Continuously assess SMB creditworthiness

- Build a faster, more sufficient credit history for small businesses that lack it

- Track performance indicators to proactively mitigate risk of delinquencies or defaults

- Predict and manage future loan loss rates

- Offer tailored advice and services that support small business needs

Noting endorsement by the Federal Reserve, CFPB, FDIC, NCUA and OCC

The use of alternative data in credit underwriting has been endorsed by the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation, the National Credit Union Administration and the Office of the Comptroller of the Currency in an Interagency Statement.

In the Interagency Statement, the Agencies recognize that the use of alternative data may improve the speed and accuracy of decisions and may help firms evaluate the creditworthiness of consumers who currently may not obtain credit in the mainstream system, enabling them to obtain additional products and/or more favorable pricing/terms based on enhanced assessments of repayment capacity. These innovations reflect the continuing evolution of automated underwriting and credit risk modeling, offering the potential to lower the cost of and to increase access to credit. However, while noting these benefits to consumers, the Agencies also note that the use of alternative data must be responsible and should comply with applicable consumer protection laws and other requirements.

Combining AI and cash flow analysis for more accurate credit risk assessments

When it comes to applying AI, there are many areas where it is used to enhance efficiency, precision and human support capabilities. JUDI.AI employs a suite of Natural Language Processing (NLP) techniques, such as stemming, tokenization, and cluster analysis to classify banking transactions for real-time cash flow analysis. Transaction sequences are then used to create time-series forecasts, anomaly detectors, and temporal signal processing variables. These variables are combined with traditional bureau and firmographic data to build SMB-specific predictive models (decision trees, neural networks, or logistic regression) for credit risk, growth, and anomaly detection that can automate, annotate, and expedite credit decisions.

By augmenting traditional credit scores with real-time cash flow analysis, you can conduct a timely review of net operating cash flow, calculate a proxy for a debt service coverage ratio (DSCR) and set post-lending alerts around risk-related events and sudden changes such as missed tax payments, declining payment deposits and NSFs. The addition of cash flow analysis to SMB credit risk modeling has been proven to help JUDI.AI customers safely expand their credit box and automatically decision on more SMB loans. The result is an increase in approval rates of up to 20%, with no added risk, over decisions based on scores alone.

Maximizing returns on small business members and customers

To summarize, with the relief program nearing its official end, now is a great time to consider innovative ways to offer small business customers the same level of efficiency, convenience and support you could offer during the PPP program – without taking on unmanageable risk.

Adopting an SMB-specific credit model that supports SMB permissioned cash flow analysis presents a chance for you to expand your credit box and get more loans and products into the hands of small businesses. You can overcome many of the variability challenges that have traditionally limited your lending to small businesses – and use more recent banking history for more accurate decisioning. This will help you maximize returns on your existing small business customers and retain more transient PPP customers.

If you are ready to discuss how incorporating cash flow data can help better determine SMB lending risk, contact JUDI.AI, and we can arrange a discussion with our team.