Say goodbye to friction

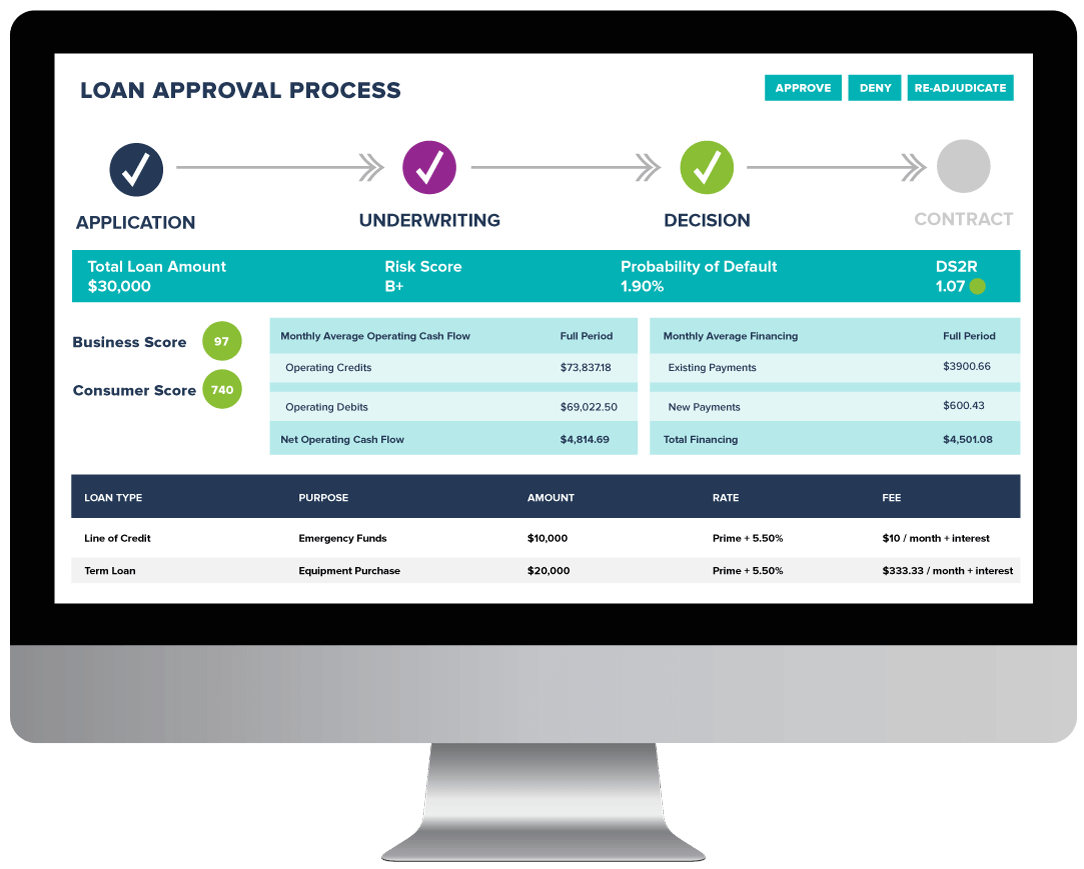

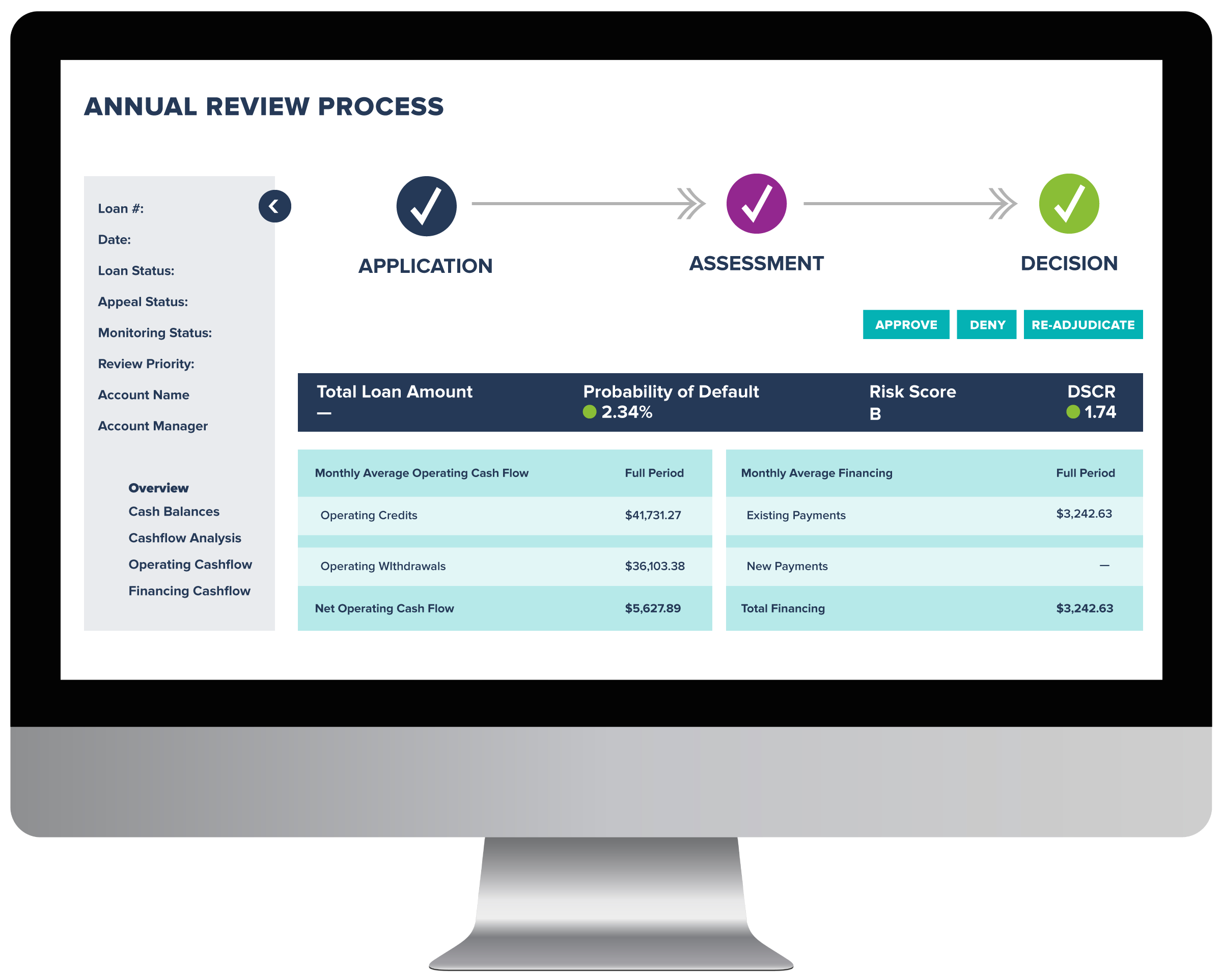

Give your small business borrowers an easy way to apply for and receive a loan decision in less than 10 minutes, while standardizing and streamlining the process for all Account Managers.

Flexible, lightweight application

JUDI can work alongside your existing loan origination system or serve as your small business LOS, with multiple core integration options possible, but not required.

Unsecured small business loans

Process applications for term loans and lines of credit under $250K, as well as credit cards.

Secured small business loans

For vehicle and equipment loans that require collateral, collect and store documentation as part of the application process.

Loan application and data collection

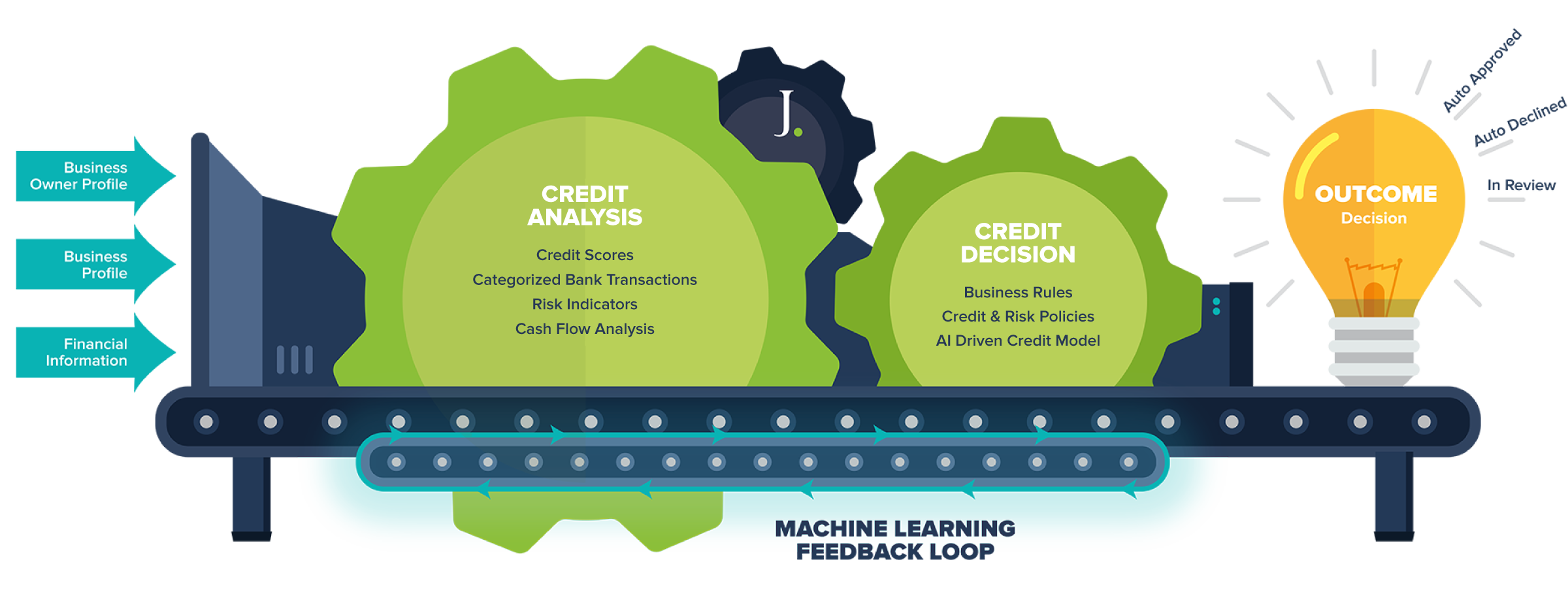

With an intuitive digital workflow — including the ability to collect credit scores and cash flow data via leading aggregators — borrowers can apply for a loan quickly and get on with their day.

Multichannel experience

Accept loan applications in branch, online or via mobile channels.

Highly configurable

Tailor a range of attributes to suit your specific needs – branding, application form, workflow, credit policies, business rules, document management, e-signatures and more.

Accept and decision small business loan applications in minutes

Easy integration

A web-based, service-oriented architecture and built-in import/export capabilities make it simple to get the data you need, including transactions, applications and files. And JUDI never charges you to access your data.

Highest standards of data security

Hosted in the Microsoft Azure cloud, the JUDI platform is fully compliant with SOC 2 Type 2 requirements.