On March 15, JUDI hosted our first CEBA Virtual Roundtable for our Canadian credit union clients, with representatives from 12 credit unions across the country participating.

Key Takeaways from Senior Executives

The session offered a unique opportunity for senior executives to collaborate and compare notes, as they seek to refinance a portion of the hundreds or even thousands of CEBA loans on their books before the loan forgiveness deadline. Below are five key takeaways from the CEBA Virtual Roundtable.

#1: Success criteria

Many credit unions have a broadly similar view of what they’re trying to achieve.

- Convert members with CEBA loans to conventional loans at a measurable conversion rate.

- Achieve an acceptable approval rate while managing risk effectively.

- Ensure the process is as efficient as possible, given the possibility for a massive influx of loan applications in the weeks leading up to the deadline.

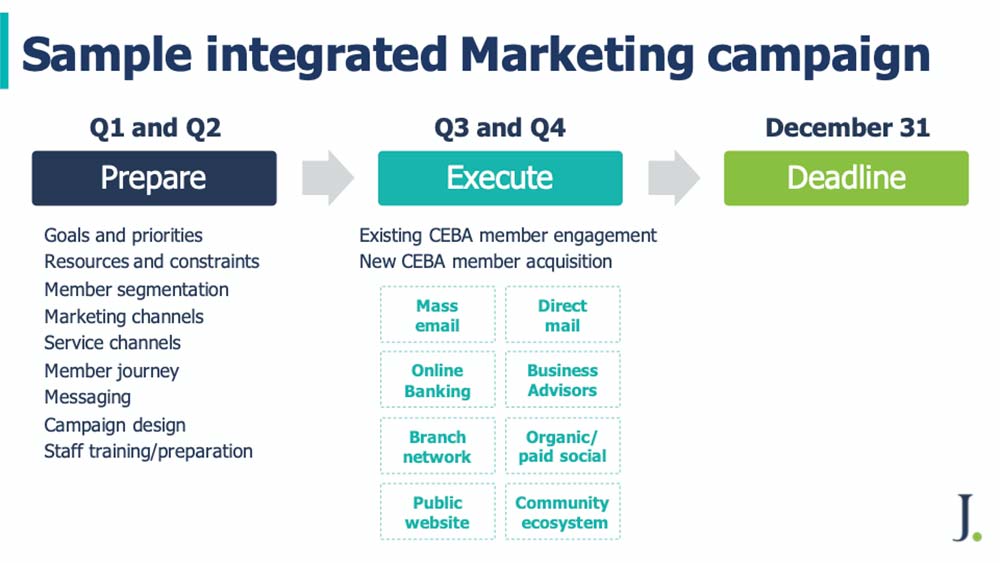

#2: The time to take action was yesterday

Although many credit unions are still in the early stages of CEBA planning, the sense of urgency is growing. To meet the December 31, 2023 deadline, you’ll realistically need to be in market in Q3.

#3: Risk strategy and adjudication

As a starting point, some have already completed an initial analysis of their CEBA portfolio from a risk management perspective. It’s possible to segment your portfolio into groups based on risk profile and relationship. For example, it could be members who are likely to be approved for refinancing vs. not likely to be approved, or members who have an existing credit relationship vs. members who only have a current account and a CEBA loan.

Much of this work can be done in advance – even as far as pre-approving members for specific loan amounts. This segmentation activity can significantly improve the effectiveness and uptake of loan offers, while remaining within the guiderails of your risk tolerance and credit policies.

#4: Marketing and communications

Using a segmented approach, most of our attendees are preparing some form of campaign out to their CEBA members this summer across a variety of channels – email, direct mail, phone calls from Business Advisors, etc. Small Business Week, which runs from October 15 to 21, 2023, is another key opportunity to reinforce CEBA messaging.

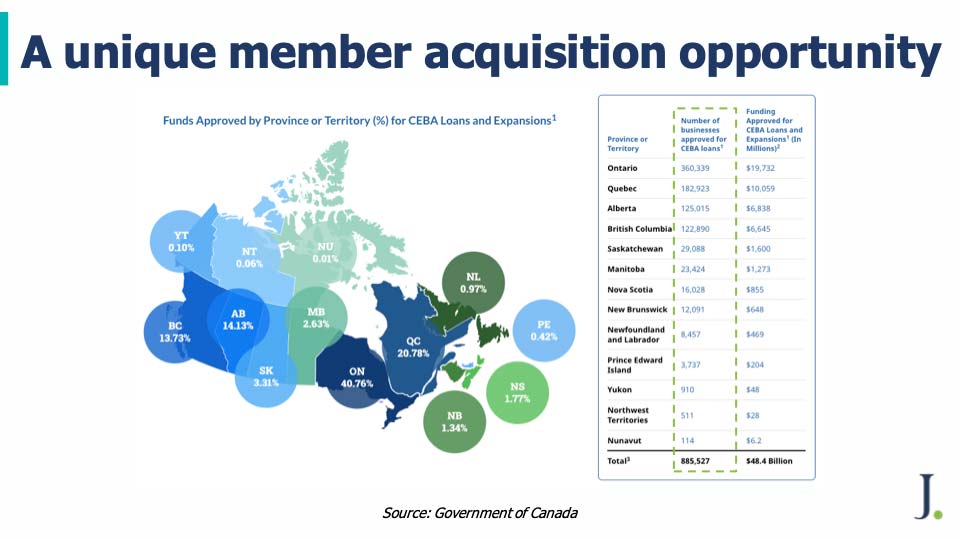

Some also view CEBA as a potential member acquisition strategy, given the hundreds of thousands of outstanding CEBA loans up for grabs across Canada. We see examples of fintech lenders already marketing their own CEBA-related offers. There’s plenty of opportunity to get creative with incentives to drive action sooner than later. What happens if the federal government extends the CEBA deadline beyond December 31, 2023? This could be a perfect window to acquire new members.

#5: Operations

One of the biggest issues on everyone’s mind was operational readiness. Aside from getting started early, how do we ensure we have enough capacity to process a large volume of loan applications in a compressed timeframe?

A few areas the group discussed:

- Focus refinancing efforts on the most appropriate member segments.

- A self-serve approach for loan applications, where a member receives a link and completes the application online, could be a good way to relieve pressure on staff capacity.

- Funding loans in batches – particularly for credit unions that may have manual processes in the back end.

- For members who have the cash and intend to repay themselves, providing a method to do so directly via online banking.

- Given the potential reputation risk that comes with being unable to complete the refinancing process for your members by December 31, a focus on efficiency and great service is critical.

JUDI can help

Our small business lending platform is purpose-built to accept and decision a large volume of loan applications quickly and easily. We’re also prepared to support our clients with a few other CEBA-related initiatives, as well, including portfolio analysis and pre-approvals, self-serve channel configuration and help with marketing strategy and execution.

Interested in discussing your CEBA refinancing strategy further? Let’s chat.