Eliminate friction in small business lending

Born and incubated inside a fintech lender, JUDI.AI enables community-based financial institutions to provide a fintech-like experience for small business loans.

Trusted by 35+ forward-thinking community lenders and counting…

“The small business lending market is large and profitable, when addressed with the right product, risk capabilities and business model.”

Source: The Economist, What is shaping the ecosystem

of small business lending?

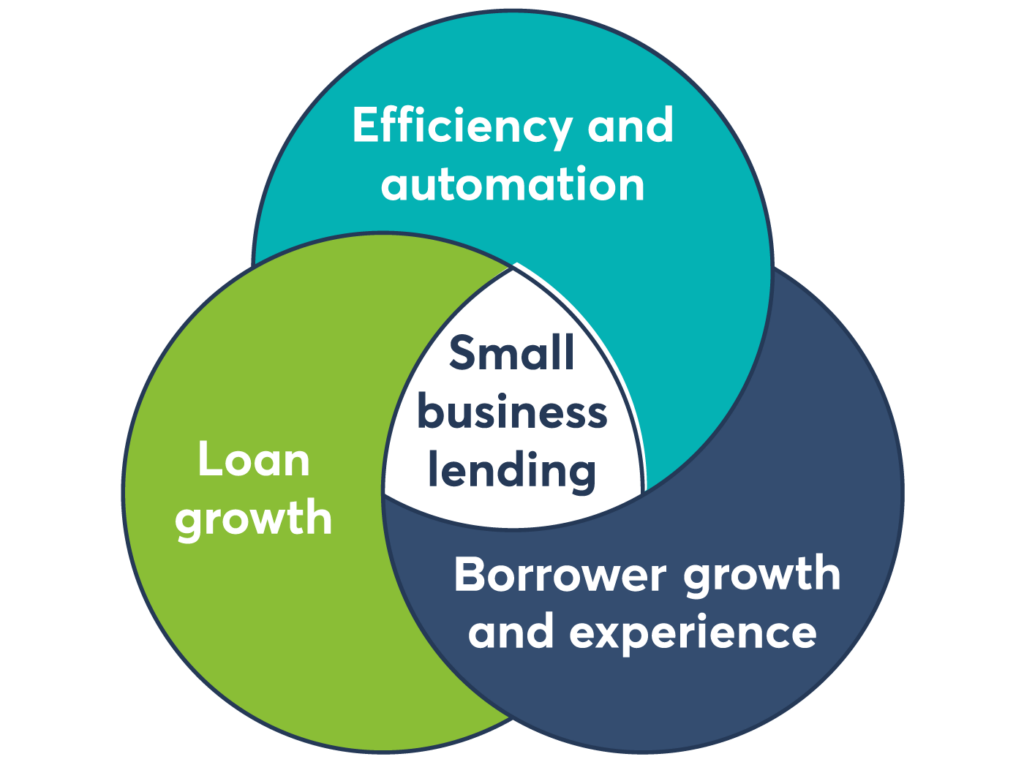

Small business lending needs its own process

Powered by AI, our cloud-based platform combines the speed of consumer lending with the right amount of rigor from commercial lending to deliver a unique cash flow-based underwriting approach.

How does your small business lending program stack up?

Old way…

• Paper-based and manual

• Relied on outdated financial statements and accounting data

• Relied on conventional lending metrics (Debt Service Coverage)

• Scorecards based on intuition

• Cumbersome approval process

• Challenging economics

• Lending like it’s 1999

New way…

• Digital and automated

• Leverages real-time banking transaction data

• Uses real-time cash flow signals to predict ability to pay

• Multivariate models based on science and performance data

• Nearly instant approval process

• Compelling economics

- • Lending like a fintech

Explore what’s possible with JUDI

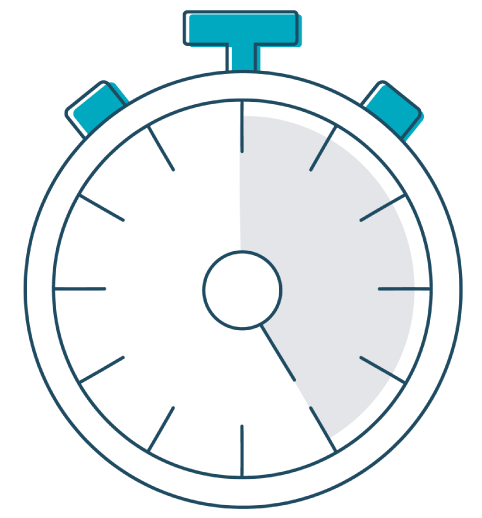

Make it quick and easy for both borrowers and staff

Reduce the application, decisioning and documentation experience from days or weeks to less than 10 minutes.

Simplify and automate the loan process

3X the volume of loan applications processed with no additional staff required.

Build and scale an attractive business

Increase approval rates by 20% with the same default rate.

Rapid implementation

With an easy-to-configure deployment tailored to your unique policies, you can be up and running in eight weeks or less.

Fulfill your brand promise

Relationships with local businesses are your competitive advantage – free up more time to better serve them.

“JUDI.AI provides borrowers with a tremendous first impression in terms of response time and quality of interaction. We can’t imagine a better technology partner in relation to our goals around servicing small businesses.”