A new article from the Globe and Mail highlights how open banking is working in Britain, noting benefits already observed and one very important lesson learned Canadian lawmakers should take note of.

If you want to skip our summary and read the whole article, click here. And, if you don’t subscribe to the Globe and Mail, don’t worry, we’ve got you covered. Keep reading for the key highlights.

Open banking overview

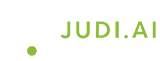

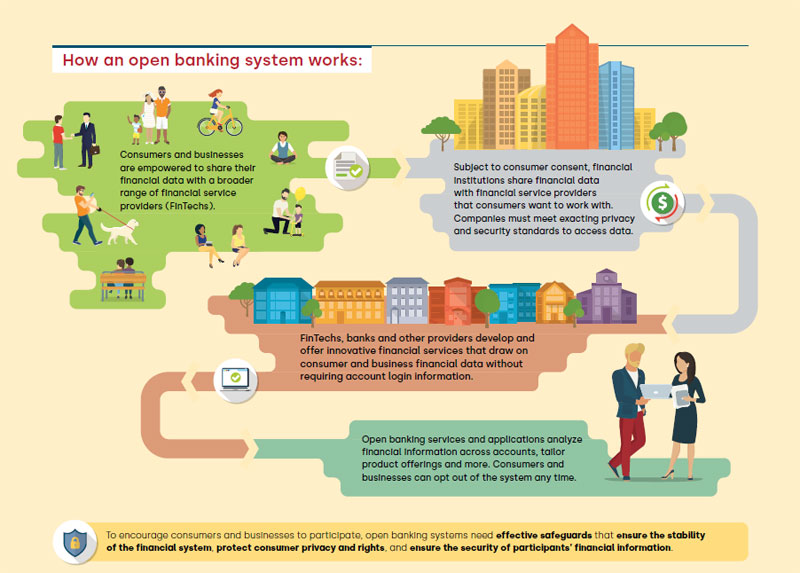

Open banking is meant to improve the banking experience by empowering consumers to share their banking and credit card data with third party providers (TPP) at their discretion. The end user is meant to have control over their financial data, ultimately forcing competition and innovation among financial institutions.

Ideally, this will result in better customer services, overall lower costs and lead to the creation of even more innovative technology in the financial services industry.

Roughly 3.5 million Canadians already use some form of fintech tools. The Financial Data and Technology Association, a.k.a. FDATA, suggests Canadian lawmakers take a “thoughtful approach that further encourages the use of these tools and balances legal requirements with the ability of the market to innovate over time,” in order to provide maximum consumer benefits.

Benefits Britain has seen so far

- Improved regulation of fintech apps

- 200 third party provider apps are on regulatory supervision in the UK

- 130 are going through the process

- Large influx of new capital into the economy

- Improved consumer experiences through collaboration

- Increased financial literacy

Consumer excitement continues to mount as “more than 7500 new customers each day are sharing their data via the open banking system by aggregating their accounts.”

Lessons learned

But the largest lesson learned so far might be the wrong choice of words. Perhaps the word “open”is not the appropriate term. It led some consumers in the UK to think their data was being shared without their permission. The writers suggest something along the lines of “consumer-directed banking” because “in a well-framed open banking system, the end user has full control and utility over their financial data. Third party providers need permission to access specific data, and consumers can revoke this permission at any time.”

Fintech is important to Canada’s economy, and continuing to drive innovation in this sector is critical not only for the future of this industry in Canada but for all Canadians. Read more about the open banking debate in our blog.