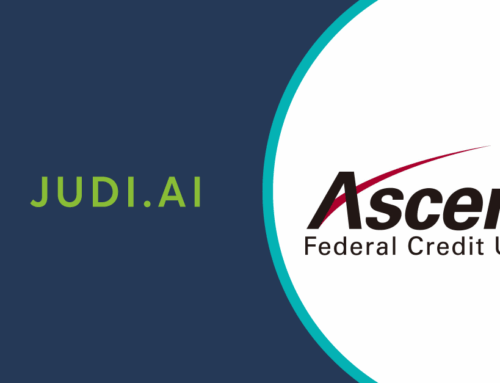

At the risk of stating the obvious, finding new sources of deposits is a hot topic for financial institutions in 2024. According to Cornerstone Advisors, 48% of banks and 49% of credit unions noted deposit gathering among their top concerns.

Increasingly, community FIs are turning to small businesses as a stable source of low-cost deposits. On average, FIs spend about half as much to acquire small business deposits than consumer deposits. And anecdotally, we’ve heard that small business deposit balances are 2X that of consumer balances.

Source: Cornerstone Advisors, What’s Going On In Banking 2024

Source: American Banker, Small Business Lending 2023: With small clients come great potential

Meanwhile, small businesses are willing to exchange stable deposits for access to credit

“The primary anchors of a small business relationship are the operating account and a lending relationship.”

Source: Curinos, Precision Pricing in Small Business Lending, June 2023

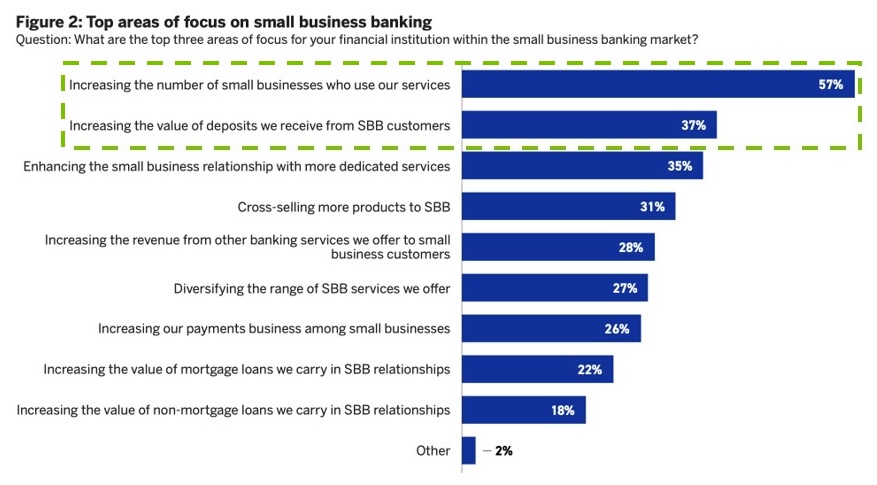

Perhaps an overlooked component of a deposit strategy (and, therefore, an untapped opportunity) is the role of small business lending.

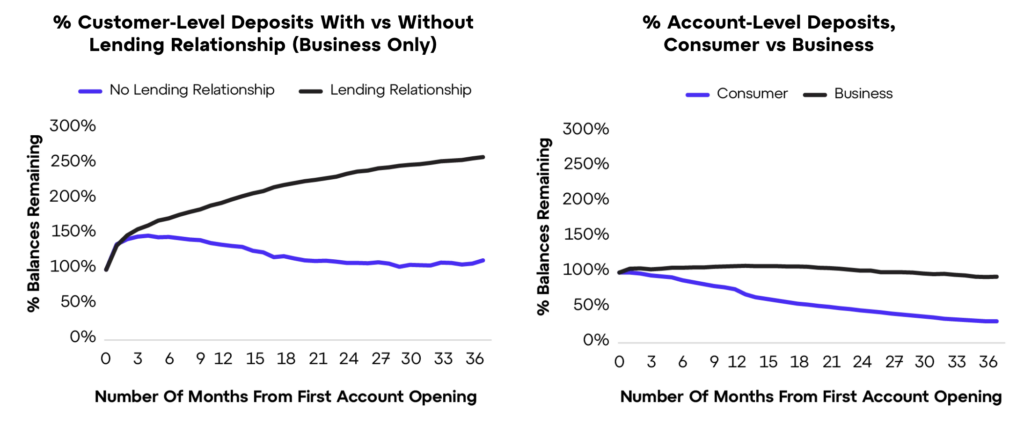

Data from Curinos suggests that securing the small business lending relationship goes well beyond meeting a customers’ borrowing needs – it also yields stronger, deeper deposit relationships over time. For small businesses with a lending relationship of 36 months or more, their deposit balances are double the size of those without a lending relationship – and triple the size of consumer accounts.

Source: Curinos, Small Businesses Offer A Clear Profitability Upside for Banks, September 2023

Implications for your small business strategy

In a recent conversation, a senior banking executive told us that right now, the institution is looking at small business lending primarily as a means to an end for securing more deposits. And there’s absolutely nothing wrong that that line of thinking. If you’re able to help solve a major strategic challenge for your organization, while also serving your members and your community at the same time, then it’s a win/win.

So where to start? Where might the lowest-hanging fruit be?

Start with the offer:

- Create an offer that links access to loans with minimum deposit balance requirements.

- Consider matching different loan sizes to different deposit requirements and levels of risk – even a $10,000 line of credit can make a significant difference for some small businesses.

- Consider basic risk-based loan pricing to help expand the pool of small businesses who qualify.

Identify and market to prospects:

- Prequalify your existing small businesses who do not have a lending relationship.

- Identify small businesses who are likely to have their primary banking relationship elsewhere.

- Identify small businesses who operate as consumers – our anecdotal data suggests that this could be as much as 7-10% of your retail members.

- Pool resources between the deposit and lending teams and incorporate this offer into your new customer acquisition efforts.

You need deposits. Small businesses need access to credit. The good news is meeting your business goals and serving your local communities do not have to be mutually exclusive. Underpinning such a strategy is the ability to quickly and easily prequalify your small business portfolio, process small business loan applications and effectively evaluate creditworthiness.