On March 27th, the Federal Government announced the $25 billion Canada Emergency Business Account (CEBA), as part of its loan and loan-guarantee program, the Business Credit Availability Program (BCAP), to support small businesses in the era of COVID-19.

This announcement left many financial institutions scrambling to produce a solution that would process the influx of online loan applications they were anticipating. With local branches reducing operating hours and staff shifting to home offices, banks and credit unions were seeking to quickly develop a self-serve digital application process.

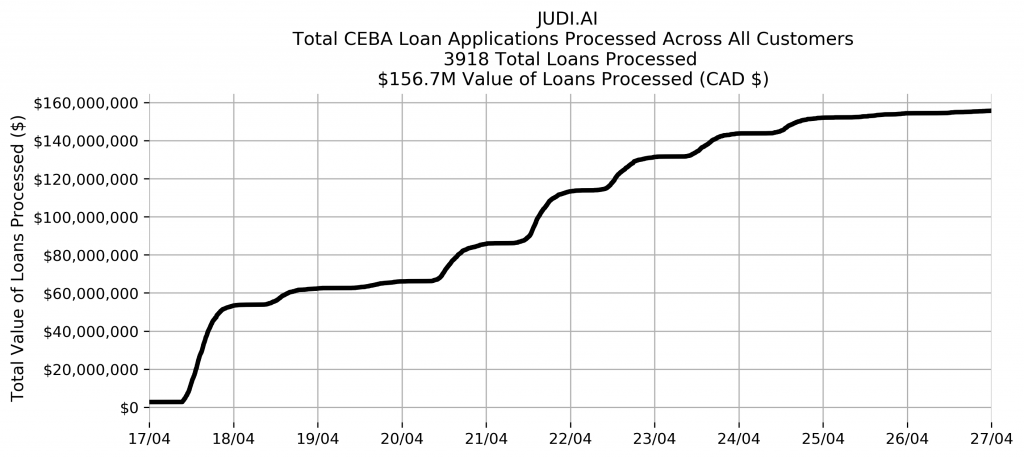

Since its inception, JUDI.AI has been working closely with its credit union clients to roll out a digital solution to support online CEBA applications to small business members. In a short period of time, JUDI.AI was able to develop, test, and deploy a digital solution in time for the official launch of the program on April 9th. To date, JUDI.AI’s CEBA digital solution has processed thousands of applications at a value of over $150 million, contributing to the total loans funded to small businesses to date.

“During these unique times, it’s an important business decision to make to steer slightly away from your short-term product roadmap in order to continue to support Canada’s small business community,” explains Gord Baizley, CEO of JUDI.AI. “We have a platform that is engineered to enable us to be nimble and make rapid deployments – allowing us to adapt in real time to the current market demand for support in operationalizing the BCAP loan programs. Our entire team has been working around the clock in order to execute on these new developments and we are extremely happy to to be able to support the small business community and our valued lending customers through this situation. It’s really been a great learning experience for our team.”

Preparing for the BDC Co-Lending Program

As the government continues to work through executing on the Business Credit Availability Program (BCAP), the team at JUDI.AI is preparing for the next wave of small business loan applications surrounding the BDC Co-Lending Program.

JUDI.AI has been working in partnership with its customers to ensure a solution will be available to the Canadian market that will support the underwriting of these loans, while also offering credit unions full visibility and tracking of these applications to help streamline government reporting.

If you’re a credit union or financial institution that’s been impacted by the CEBA or the upcoming BDC Co-Lending Program, we’d like to hear from you.

“When COVID-19 arrived on our doorstep in Saskatchewan and there was a need to find a very quick solution to support our business members; one text message and a Zoom call with the whole JUDI.AI team was all it took. There was no hesitation about how they could help and the support they could provide to us. The care and flexibility they had in working with us to provide this solution in less than 2 weeks was remarkable.

Today, we have funded in excess of $50 million in CEBA loans to Saskatchewan Business and JUDI.AI has been instrumental in our ability to do so.”

Maggie Sinclair, Executive Vice President, Business Banking

Conexus Credit Union

“I was very impressed with both the speed and the attention to detail the JUDI.AI team displayed during our on-boarding process with them. They played a key role in helping DUCA launch our CEBA Program in just under 2 weeks. Our first batch of funding has come in without any questions or concerns from EDC…in fact the funding came in 1 day earlier than expected!“

M.A. (Mo) Mauri, Senior Vice President, Commercial Banking – DUCA Credit Union Ltd.

“Our partnership with JUDI.AI has been instrumental in Servus being able to provide our members quick and easy access to the Canadian Emergency Business Account (CEBA) Program. Our members access the JUDI.AI portal from their homes and businesses which keeps them and our staff safe during this time of social distancing. JUDI.AI reacted promptly when the CEBA payroll parameters changed to ensure all eligible members can apply for the program. The JUDI.AI team is responsive to our many questions and focused on providing a great experience for Servus and our members.”

Elsa Prendergast, Senior Manager Loan Systems – Servus Credit Union

“The JUDI team quickly mobilized to help FirstOntario offer our Members a critical financial solution. No matter what the time, their team was always accessible to answer questions and support our requests. Strong collaboration on both sides created a successful partnership that delivered exactly what our Members needed, sooner than we expected.”

Rob Cefaratti, SVP, Business Banking Group & Alternative Investments – FirstOntario Credit Union